Look at all tax preparation and filingTax credits and deductionsTax formsBest tax softwareTax preparation Fundamentals

Terugkoopgarantie Gegarandeerde terugkoop fulfilled vaste biedprijsgarantie, ongeacht volume en hoogte van de koers.

A SDIRA is taken into account “self-directed” mainly because Though a custodian or trustee administers the account, it’s the account holder who straight manages the investments and assumes all chance.

John Parker is a business author with twenty+ years of knowledge as a company govt specializing in accounting and finance.

In a normal self-directed IRA, your custodian disburses resources at your ask for. Some custodians normally takes per month or even more to ship the funds, and a lot of cost a price for this services.

As you’re possibly conscious, it can really set you back should you operate afoul from the IRS. The stakes are particularly substantial with self-directed IRAs because if you split on the list of IRS’ strict rules regarding the investments you maintain in retirement accounts And exactly how you make use of them, your total self-directed account may very well be liable and penalized.

And if buying real estate property, precious metals or perhaps startups is more info here important for you however , you don’t want the hassle of managing a self-directed IRA, don’t neglect which you can attain publicity to lots of

A self-directed IRA is like a typical IRA in almost every way, with the foremost change remaining what it might spend money on. Investors can choose from two major varieties:

NerdWallet's articles is fact-checked for accuracy, timeliness and relevance. It undergoes a thorough critique process involving writers and editors to be sure the knowledge is as crystal clear and comprehensive as feasible.

These kinds of assets may have returns greater than you could get buying just the stock sector, but In addition they contain A lot higher risks.

These procedures are really straightforward to adhere to once you’re investing with a standard IRA. But matters get murky if you’re working with substitute asset lessons.

Not all IRA companies present self-directed accounts. Between those who do, price buildings and have sets can vary considerably. The very best self-directed IRA custodian for yourself would be the one which is not hard to know and serves your unique desires at an affordable price.

“Inside of a self-directed IRA you'll be able to spend money on substitute investments, which include industrial house or LLC membership desire, which are not permissible in a conventional IRA held by a brokerage enterprise,” he says.

Check out a lot more auto loan resourcesBest car loans permanently and lousy creditBest auto loans refinance loansBest lease buyout loans

Alisan Porter Then & Now!

Alisan Porter Then & Now! Christina Ricci Then & Now!

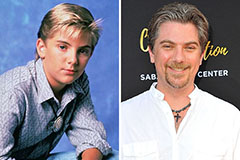

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now!